Ethereum Price Prediction: Analyzing the Path to $4,500 and Beyond

#ETH

- Technical Strength: ETH trading above 20-day MA with Bollinger Band support suggests continued upward potential

- Whale Accumulation: Large holders buying during corrections indicates strong institutional confidence

- Resistance Levels: $4,500 serves as critical psychological barrier, with $4,788 as next major target

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

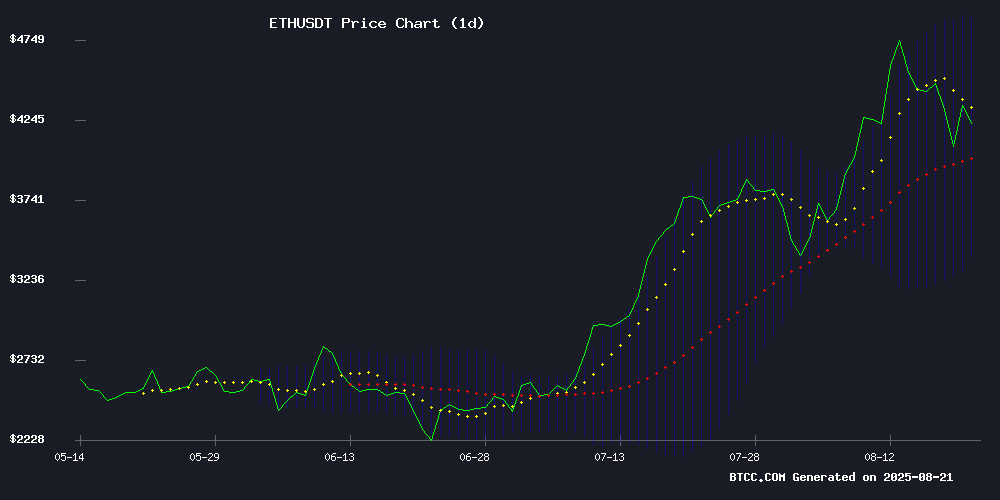

ETH is currently trading at $4,287.67, firmly above its 20-day moving average of $4,139.70, indicating underlying bullish momentum. The MACD reading of -58.36, while negative, shows improving momentum as the histogram narrows. The price sits comfortably within the Bollinger Band range ($3,384.65-$4,894.75), with room to test the upper band resistance around $4,895.

According to BTCC financial analyst James, 'The technical setup suggests ETH has consolidated healthily and is positioned for a potential breakout. Holding above the 20-day MA is crucial for maintaining bullish structure.'

Market Sentiment: Mixed Signals Amid Institutional Flows and Whales Accumulation

News sentiment presents a balanced yet cautiously optimistic outlook. Positive developments include Singapore's DBS Bank pioneering tokenized notes on ethereum and whale accumulation during the recent correction. However, institutional outflows of $422 million and a $4 billion supply overhang create near-term headwinds.

BTCC financial analyst James notes, 'The market is experiencing typical consolidation after strong gains. Whales accumulating at these levels suggests confidence in Ethereum's long-term value proposition, though technical barriers around $4,500 need to be convincingly broken.'

Factors Influencing ETH's Price

Singapore's DBS Bank Pioneers Tokenized Notes on Ethereum

DBS Bank, Singapore's largest financial institution, is breaking new ground in blockchain adoption by issuing tokenized structured notes on the ethereum network. The move signals growing institutional confidence in blockchain-based financial instruments.

These digital securities will be offered exclusively to accredited and institutional investors through local exchanges, leveraging Ethereum's smart contract capabilities to streamline issuance and settlement. The initiative positions DBS at the forefront of Asia's digital asset innovation.

Ethereum Price Rallies 3% Ahead of Fed’s Jackson Hole Meeting

Ethereum surged over 3% in early trading, peaking at $4,368.07 before retracing to $4,301.80. The second-largest cryptocurrency now shows a 2.9% daily gain, with more impressive 17.5% and 16.9% climbs across fortnightly and monthly windows respectively. Since August 2024, ETH has delivered 65.9% returns.

All eyes turn to the Federal Reserve's Jackson Hole symposium (Aug 21-23), where policymakers' remarks could catalyze further momentum. Market participants anticipate dovish signals, with a September rate cut probability now priced in. Ethereum remains 11.8% below its $4,878.26 all-time high, leaving room for upside should macroeconomic conditions align.

Ethereum Price Gains Fade as Key Barriers Hold Firm, Another Dip Possible

Ethereum's recovery attempt from the $4,050 support zone has stalled NEAR critical resistance levels. The second-largest cryptocurrency briefly reclaimed $4,220 but now faces strong selling pressure below the $4,350 mark, with technical indicators suggesting potential for further downside.

A bearish trend line forming at $4,355 on the hourly chart coincides with the 61.8% Fibonacci retracement level of the recent decline from $4,580 to $4,065. This confluence of resistance factors has capped upward momentum, keeping ETH below both the trend line and its 100-hour moving average.

The market structure remains fragile following ETH's failure to hold above $4,250. While the $4,065 low established a temporary floor, the lack of follow-through buying above $4,350 indicates weak demand at current levels. Traders are watching the $4,220 zone as immediate support, with a breakdown potentially accelerating losses.

Ethereum Whales Accumulate Amid Market Correction, ETH Eyes $4,500 Recovery

Ethereum (ETH) demonstrated resilience with a 5% rebound from the $4,100 support level, as large-scale investors absorbed selling pressure from retail profit-taking. Whale addresses holding 10K-100K ETH accumulated 550,000 ETH during the recent 10% price dip, signaling strong conviction at elevated valuations.

Futures market dynamics reveal a brewing short squeeze scenario. Net short positions in ETH derivatives have approached December 2023 levels—a period preceding a 60% price collapse. Over $100 million in short positions were liquidated during Wednesday's 6% rally, according to Coinglass data.

The market structure presents a dichotomy: while institutional players accumulate spot ETH, retail traders continue realizing profits exceeding $4 billion. This divergence suggests potential for continued volatility as opposing forces collide.

Ethereum Sell-Offs Intensify as Institutional Outflows Reach $422 Million

Ethereum's rally above $4,800 has hit a wall. The cryptocurrency plunged below $4,100 after institutional investors yanked $422.3 million from US spot ETFs in a single day—the second-largest daily outflow on record. Grayscale and Fidelity led the retreat, with BlackRock's iShares Ethereum Trust shedding $1.1 billion in assets.

The sell-off compounds existing technical weakness. ETH had already retreated from its August 14 peak of $4,776, a level that coincided with its "Active Realized Price" resistance zone. Market observers now question whether the asset can sustain momentum toward new all-time highs amid waning institutional support.

Ethereum Nears $4K as $4B Supply Overhang Looms: Analysts Fear Deeper Losses

Ethereum (ETH) teeters near the $4,000 threshold amid a $3.91 billion staking withdrawal queue, sparking fears of further downside. The asset has shed 9% in a week, with $178 million in liquidations—$127 million from ETH longs—highlighting market fragility. One Hyperliquid trader lost $6.2 million in two days, underscoring the volatility.

Institutional players counter retail distress: Bitmine Immersion added 52,475 ETH ($6.6 billion total), while FalconX-linked wallets injected $38 million. Despite SharpLink's underwater 143,593 ETH purchase at $4,648, whales signal long-term conviction. The clash between looming supply pressure and institutional accumulation frames ETH's pivotal moment.

Ethereum Price Squeezed In Falling Channel – Bulls Eye Rebound To $4,788 If This Support Holds

Ethereum is consolidating within a falling channel after its recent rally, with $4,150 emerging as a critical support level. A hold above this zone could pave the way for a retest of the $4,788 resistance, while a breakdown may trigger a deeper correction toward $3,900.

Ash Crypto's analysis highlights ETH's current position at $4,190, just above the $4,150 support. The falling channel pattern suggests short-term corrective pressure, but a breakout could reignite bullish momentum toward all-time highs.

Ethereum Tests Key Resistance Amid Bullish $10K Cycle Speculation

Ethereum's resurgence challenges market expectations as ETH tests the $4,350 resistance level, sparking debate over a potential $10,000 valuation this cycle. The asset has gained 15% in 30 days, reclaiming a $4,700 local high unseen since 2021's smaller-cap market era.

Vitalik Buterin's renewed focus on upgrades contrasts with Ethereum's earlier stagnation during Solana's dominance. SharpLink's accumulation of 740K ETH ($3.1B) signals institutional confidence, while the $4K support level now acts as a springboard for price momentum.

The RSI neutrality at current levels suggests either imminent breakout or retracement, with $4K support and $4,350 resistance forming critical technical boundaries. Market observers note Ethereum's fundamental improvements could justify unprecedented price targets despite historical volatility.

Ethereum’s Price Faces Drop Below $3,000 As Long-Term Holders Signal Potential Selling Pressure

Ethereum's price risks falling below the $3,000 threshold as long-term holders (LTHs) exhibit signs of profit-taking. The MVRV Long/Short Difference has hit a yearly high, indicating substantial unrealized gains among LTHs. Historically, such conditions precede increased selling activity.

The Net Unrealized Profit/Loss (NUPL) metric for Ethereum LTHs has reached an 8-month peak, reinforcing the likelihood of a market top. While robust holder profitability typically reflects strength, it also raises the specter of cascading sell-offs if these investors capitalize on gains.

OpenServ Appoints Joey Kheireddine as Head of Blockchain to Accelerate Onchain AI Roadmap

OpenServ, a leading Web3 AI infrastructure provider, has named Joey Kheireddine as its new Head of Blockchain. Kheireddine joins from Eliza Labs, where he served as Head of Engineering, bringing extensive experience in decentralized applications and AI-agent frameworks.

"Joey has shipped at a pace and quality most teams struggle to match," said OpenServ CEO Tim Hafner, highlighting Kheireddine's track record of handling over 70,000 ETH in combined marketplace volume and $50M+ in revenue across various Web3 projects since 2017.

The appointment signals OpenServ's commitment to bridging AI and blockchain technologies. Kheireddine's mandate includes hardening the platform's infrastructure and streamlining development for teams building AI-powered applications. "My goal is to make OpenServ the easiest path for launching agentic AI apps," he stated.

Kheireddine's prior work on AI-integrated token launchpads at Eliza Labs aligns with OpenServ's vision for intelligent onchain systems. The MOVE comes as Web3 increasingly converges with artificial intelligence, particularly in decentralized infrastructure development.

Ethereum Eyes $5.1K After Healthy Pullback to $4,150, Analyst Predicts

Ethereum's price trajectory is drawing bullish attention as analysts project a rebound toward $5,100 following a brief correction. FundStrat's Tom Lee and Mark Newton anticipate ETH stabilizing near $4,000-$4,150 this week, framing the dip as a constructive reset before renewed upside. The asset briefly tested $4K support on August 19—a level that previously served as resistance earlier this year.

Market structure reinforces the optimism. Exchange reserves have plummeted to annual lows, signaling reduced sell pressure as holders migrate ETH to self-custody or staking protocols. Meanwhile, CME's ETH futures open interest surged to $8 billion, reflecting institutional appetite despite recent price volatility. Technical analysts highlight the $4K zone as critical; maintaining this foothold could catalyze the next leg toward record highs.

How High Will ETH Price Go?

Based on current technical and fundamental analysis, ETH appears poised for a move toward $4,500 in the near term, with potential to reach $4,788 if bullish momentum sustains. The convergence of technical support at the 20-day MA ($4,139.70) and whale accumulation provides a solid foundation for upward movement.

| Price Level | Significance | Probability |

|---|---|---|

| $4,500 | Key psychological resistance | High |

| $4,788 | Technical target (channel breakout) | Medium |

| $5,100 | Analyst projection after healthy pullback | Medium-Low |

BTCC financial analyst James emphasizes that 'While the $4,500 level presents immediate resistance, Ethereum's strong fundamentals and institutional adoption could propel prices higher toward $5,100 if market conditions remain favorable.'